+12

NĂM KINH NGHIỆM

+40

ĐỘI NGŨ NHÂN SỰ

+100

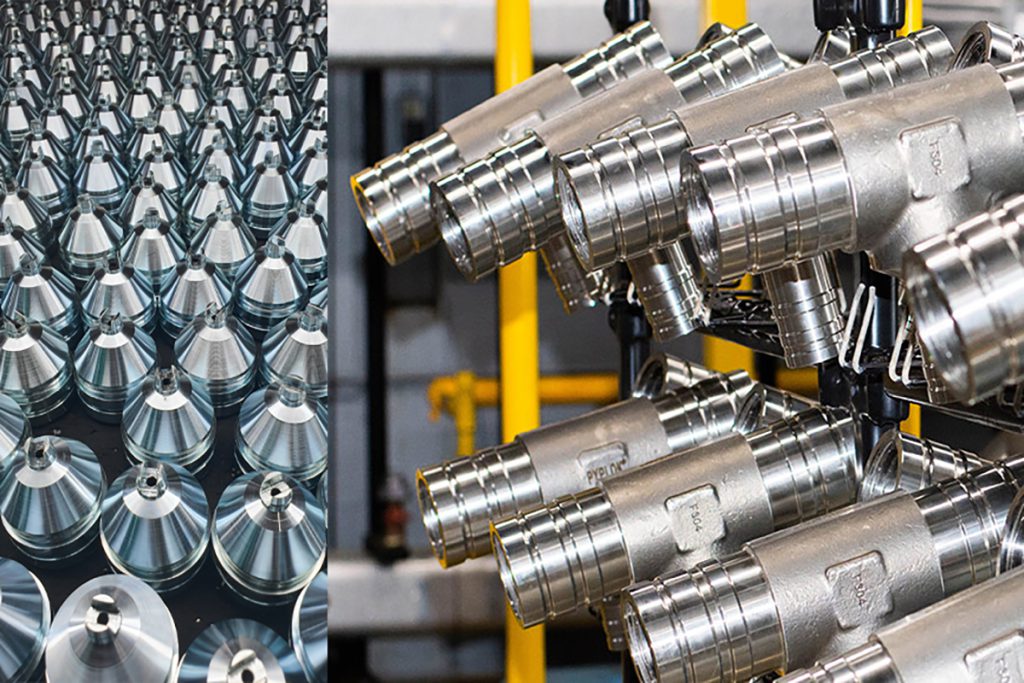

Các loại sản phẩm đã gia công

+30

ĐỐI TÁC TIN TƯỞNG LÂU DÀI

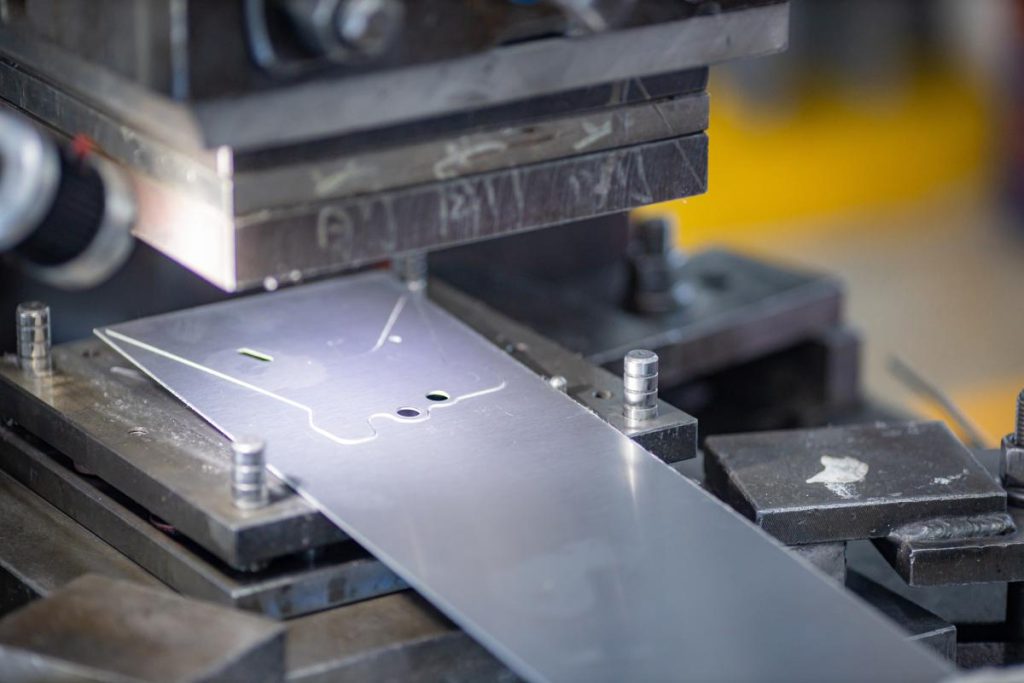

Công Nghệ

Sản phẩm của Plato được ứng dụng trong nhiều lĩnh vực công nghiệp, xây dựng, công nghiệp điện, công nghiệp hàng hải, cơ khí chế tạo, ô tô và các phụ kiện khác.

Có 2 phương pháp mạ kẽm là mạ kẽm điện phân và mạ kẽm nhúng nóng. Ưu nhược điểm của 2 phương pháp

Mạ kẽm thụ động Cr+3 được xem là công nghệ xi mạ kẽm tiên tiến và hiện đại nhất hiện nay, được dùng

Plato Việt Nam luôn đi đầu trong ứng dụng công nghệ hiện đại nhằm giảm thiểu ảnh hưởng đến môi

Mạ kẽm là hình thức mạ một lớp kẽm lên bề mặt kim loại nhằm tạo một lớp bảo vệ cho bề mặt, giúp

Sơn phủ vảy kẽm - MẠ GEOMET và Mạ Dacromet với quy trình Dip-spin / Spray tại Faridabad các loại

MẠ DACROMET LÀ GÌ? Mạ Dacromet là tên gọi một công nghệ mạ chống ăn mòn chất lượng cao. Thành

Yêu cầu tư vấn

Vui lòng để lại thông tin ở form bên dưới. Đội ngũ tư vấn của chúng tôi sẽ liên hệ với bạn trong thời gian sớm nhất!

Tin tức

Có 2 phương pháp mạ kẽm là mạ kẽm điện phân và mạ kẽm nhúng nóng. Ưu nhược điểm của 2 phương pháp

“Hiện nay tại Việt Nam đã có doanh nghiệp dần chuyển đổi công nghệ mạ kẽm điện phân dụng các nguyên

Muốn thâm nhập thị trường EU, các sản phẩm cơ khí từ Việt nam cần phải đáp ứng được các tiêu chuẩn

Cảm nhận khách hàng

Chất lượng của các sản phẩm mạ kẽm và sơn phủ vảy kẽm GEOMET của PLATO luôn đảm bảo độ chống ăn mòn cao và ổn định

Bãi Bông, Tx. Phổ Yên, Thái Nguyên

PLATO là đối tác tin cậy trong nhiều năm để gia công các sản phẩm cột chống sàn xuất khẩu phục vụ cho thị trường Nhật Bản

Phan Chu Trinh, Hoàn Kiếm, Hà Nội

Các sản phẩm mạ kẽm của công ty PLATO đảm bảo các tiêu chuẩn về chất lượng cũng như thân thiện với môi trường theo đúng cam kết

KCN Yên Mỹ II, Yên Mỹ, Hưng Yên

Chúng tôi cảm thấy yên tâm và tin tưởng vào lớp phủ GEOMET dùng trong bu lông ốc vít của PLATO VIET NAM

Khu công nghiệp Đình Trám, Thị Trấn Nếnh, Huyện Việt Yên, Tỉnh Bắc Giang, Việt Nam